As the world increasingly pivots towards advanced technologies, China's manufacturing prowess is reshaping the landscape of electronic components, particularly in the realm of rigid flex PCBs. These versatile circuit boards, known for their combination of rigidity and flexibility, are essential in modern electronic devices, fostering innovation in compact design and multi-functionality. China's commitment to elevating industry production standards has not only enhanced the quality and reliability of rigid flex PCBs, but has also positioned the country as a leader in meeting the growing demands of various sectors, from consumer electronics to medical devices.

This blog explores how China's manufacturing revolution is not only transforming the production of rigid flex PCBs but also setting new benchmarks for the industry, ultimately paving the way for the technological advancements of the future.

China's dominance in the rigid flex PCB manufacturing sector is increasingly shaping the future of this pivotal industry. As the market for rigid flex PCBs in China was valued at approximately USD 3.62 billion in 2024, it is projected to grow at an impressive compound annual growth rate (CAGR) of 12.4%. This surge is driven by the growing demand across various sectors, particularly in automotive and consumer electronics, where the integration of advanced technology is becoming crucial.

Moreover, the overall global rigid flex PCB market is anticipated to expand from USD 25.7 billion in 2024 to USD 77.7 billion by 2034, reflecting a CAGR of 11.70%. This remarkable growth can be attributed to innovations in design and manufacturing processes, which have allowed for more efficient production and enhanced product performance. With China's continued commitment to evolving its manufacturing capabilities, it is well-positioned to not only lead in the production of rigid flex PCBs but also influence global trends and standards in the industry.

| Year | Global Market Share (%) | Estimated Revenue (Billion USD) | Number of Manufacturers | Export Rate (%) |

|---|---|---|---|---|

| 2018 | 25 | 4.5 | 150 | 60 |

| 2019 | 30 | 5.0 | 160 | 62 |

| 2020 | 35 | 5.8 | 175 | 65 |

| 2021 | 40 | 6.7 | 180 | 67 |

| 2022 | 45 | 7.5 | 190 | 70 |

| 2023 | 50 | 8.4 | 200 | 73 |

China has emerged as a dominant force in the rigid flex PCB market, showcasing a remarkable growth trajectory that has reshaped global manufacturing dynamics. According to a recent report by Research and Markets, the rigid flex PCB market is expected to reach USD 18 billion by 2027, with Chinese manufacturers accounting for over 50% of the global market share. This dominance is fueled by China's robust supply chain, technology advancements, and significant investments in production capabilities.

Chinese rigid flex PCB producers are not only increasing their market share but also enhancing innovation in design and functionality. A study by Future Market Insights highlights that leading Chinese firms, such as Zhen Ding Technology, have made substantial advancements in miniaturization and flexibility, allowing for applications in high-tech sectors including telecommunications and automotive industries. As the demand for lightweight and compact electronic devices surges, China is well-positioned to continue leading the market with its scalable production capabilities and cutting-edge technology.

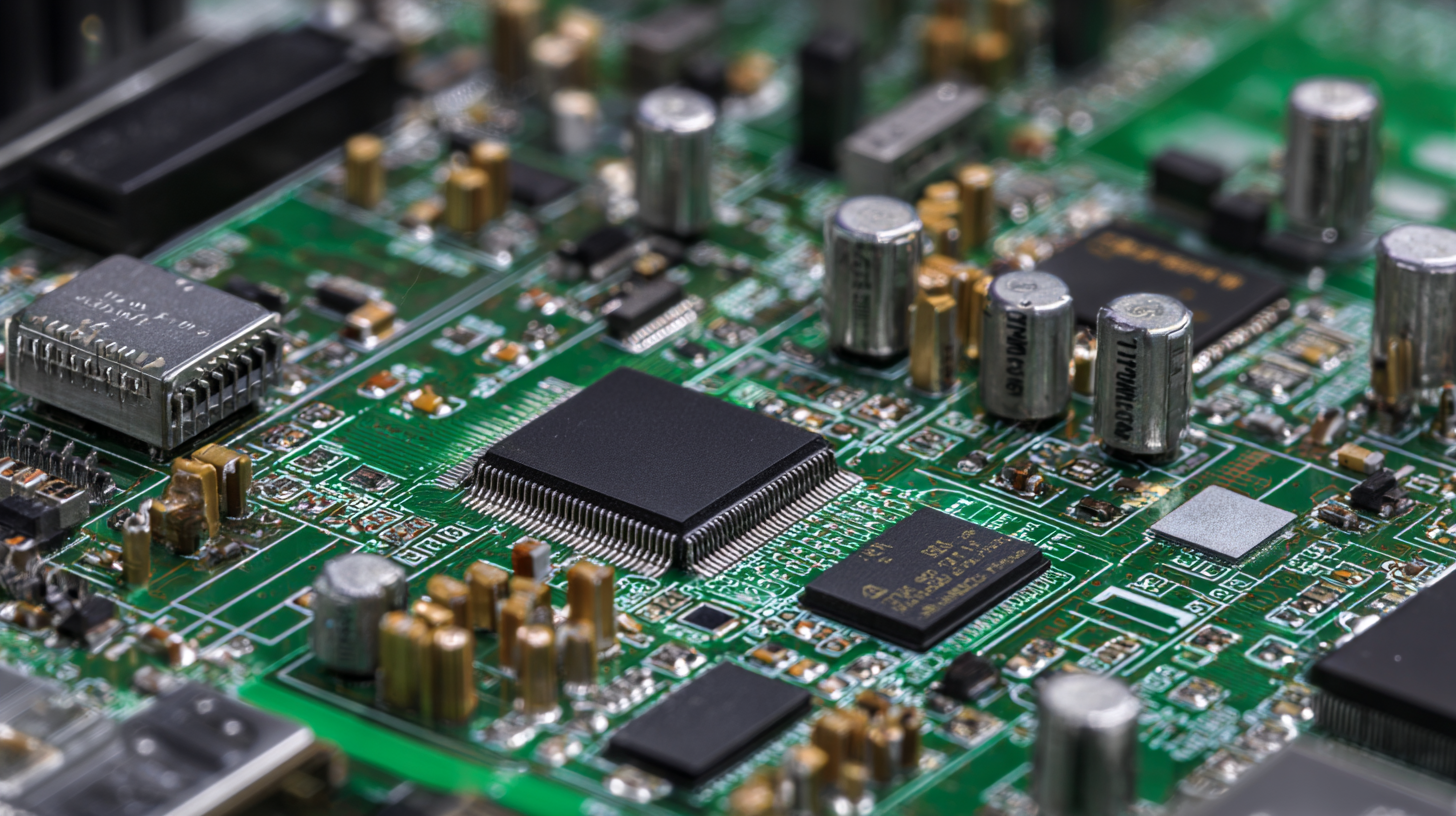

China's advancements in rigid flex printed circuit boards (PCBs) are revolutionizing the electronics industry, driven largely by technological innovations that enhance efficiency and performance. According to a report by Market Research Future, the global rigid flex PCB market is expected to grow at a CAGR of 10.10% from 2022 to 2030, with China spearheading this growth due to its robust manufacturing capabilities and commitment to research and development. This surge is attributed to a combination of automation in production processes and sophisticated design software that streamline the manufacturing workflow, resulting in higher yield rates and reduced costs.

Moreover, China's focus on developing advanced materials for rigid flex PCBs is a vital aspect of their innovation. The adoption of high-frequency laminates and flexible substrates has allowed manufacturers to create PCBs that not only meet but exceed the demanding specifications of modern electronic devices. A recent analysis from Research and Markets highlighted that the use of flexible circuit technology in the automotive and telecommunications sectors is driving significant demand for rigid flex designs. This transition reflects a broader trend towards miniaturization and enhanced functionality, solidifying China's position as a leader in the global PCB market.

This chart illustrates the trends in production output and technological advancements in China's rigid flex PCB manufacturing over the last five years, showcasing the rapid growth driven by innovation.

China's rigid flex PCB manufacturing is not just a testament to its engineering prowess but also a leader in adopting sustainable practices. As the demand for electronics grows, the push for environmentally friendly production processes has become paramount. Many Chinese manufacturers are integrating green technologies, such as water-based soldering and energy-efficient machinery, which significantly reduce harmful emissions and waste. These initiatives not only minimize the ecological footprint of PCB production but also align with global regulatory standards and consumer expectations for sustainability.

China's rigid flex PCB manufacturing is not just a testament to its engineering prowess but also a leader in adopting sustainable practices. As the demand for electronics grows, the push for environmentally friendly production processes has become paramount. Many Chinese manufacturers are integrating green technologies, such as water-based soldering and energy-efficient machinery, which significantly reduce harmful emissions and waste. These initiatives not only minimize the ecological footprint of PCB production but also align with global regulatory standards and consumer expectations for sustainability.

The rise of sustainable manufacturing practices has also led to innovation in materials used in rigid flex PCBs. Manufacturers are increasingly utilizing recyclable materials and bio-based resins, which contribute to a circular economy. This shift not only enhances the durability and performance of PCBs but also ensures that the manufacturing processes are less harmful to the environment. By leading the charge in sustainable rigid flex PCB production, China is setting a benchmark for the industry, ultimately reshaping the future of electronics in a responsible manner.

China's influence on the global rigid flex PCB supply chain is undeniable as the country continues to bolster its manufacturing capabilities. The rapid growth of the automotive printed circuit board market highlights this transformative trend, with forecasts projecting significant increases in market size over the next decade. By 2034, the global automotive PCB market is expected to reach approximately USD 18.14 billion, driven by the rising demand for advanced electronics in electric vehicles. As a result, Chinese PCB fabricators are not only enhancing their production capabilities but also ensuring they remain integral players in this dynamic landscape.

Furthermore, the rigid flex PCB market is experiencing a substantial surge, projected to grow from USD 25.7 billion in 2024 to an impressive USD 77.7 billion by 2034. This growth is driven by advancements in technology and the increasing need for miniaturized components in various applications. As international trade relationships evolve and tariffs reshape the marketplace, China's strategic positioning will be crucial for global supply chain continuity. Enhanced collaboration among different nations underscores the importance of Chinese manufacturers in supporting the global electronics ecosystem, ensuring they play a pivotal role in shaping future innovations.

Address :

Absolute Electronics Services LLC

330 W Fay Ave

Addison, IL – 60101

2025 Absolute Electronics Services, All Rights Reserved